Picture supply: Getty Pictures

I’m constructing an inventory of prime FTSE 100 and FTSE 250 shares to purchase after I subsequent have money to speculate. Listed below are two I’m hoping to purchase earlier than their share costs spring increased.

Business large

Monetary providers suppliers like Authorized & Basic Group (LSE:LGEN) face an ongoing battle to develop earnings as powerful financial circumstances sap shopper spending.

Between January and June final 12 months, working revenue at this specific FTSE 100 agency dropped 2%. However the prospect of additional short-term stress doesn’t put me off. I opened a stake within the life insurance coverage, wealth and pensions large final 12 months as I imagine it should ship distinctive long-term returns.

And at present costs, I’m hoping so as to add to my holdings. At 239p per share, it carries an excellent 9% dividend yield for 2024, whereas its price-to-earnings (P/E) ratio sits at a rock-bottom 9.1 occasions.

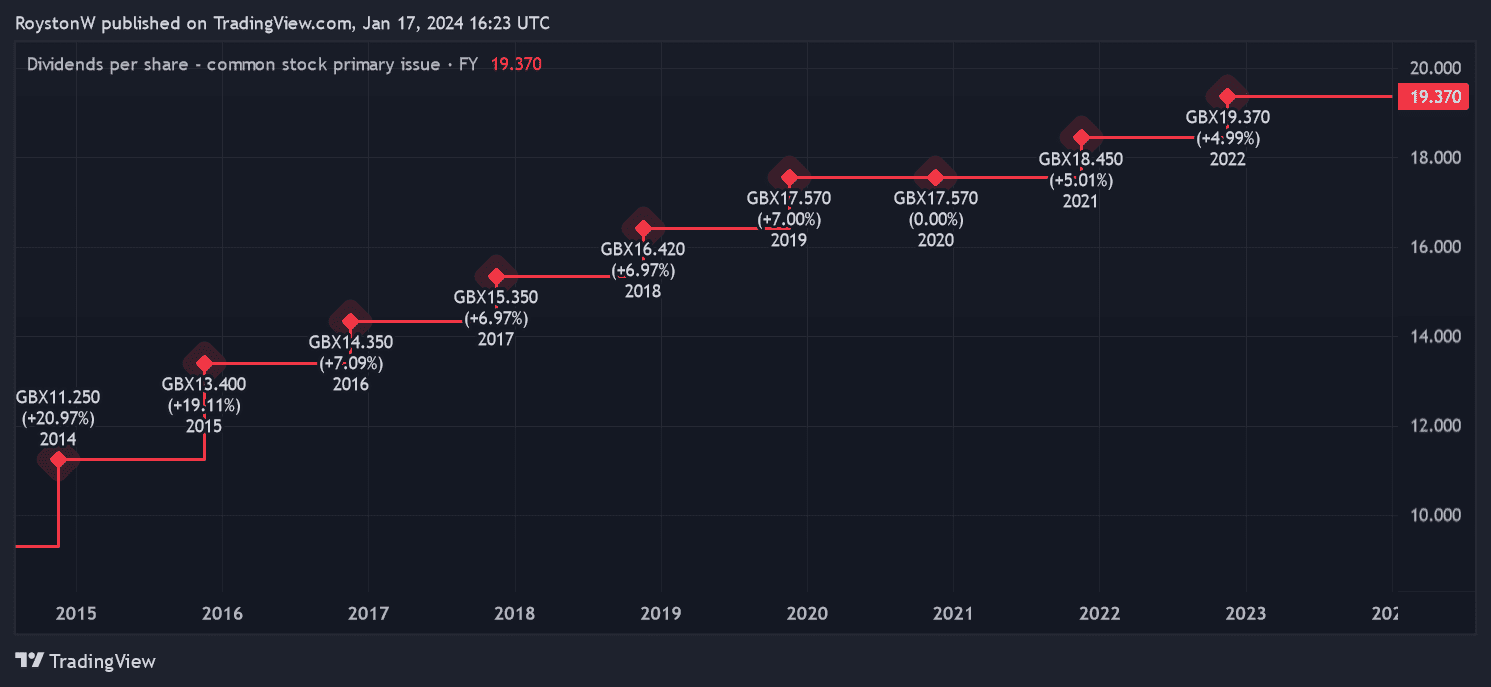

Dividend development at Authorized & Basic since 2014. Chart by TradingView

Authorized & Basic is a frontrunner in monetary providers, and within the UK it has round 10m policyholders throughout the financial savings, safety, mortgage and retirement segments. As populations quickly age throughout its territories, it has a fantastic probability to develop buyer numbers sharply from present ranges.

I additionally like L&G shares due to the corporate’s cash-rich stability sheet. A powerful solvency ratio (which got here in at 230% in June) offers it firepower to make acquisitions, put money into the enterprise, and to proceed rising the dividend.

Sunny facet up

Investing in renewable vitality shares might additionally assist me make terrific returns because the transfer away from fossil fuels accelerates. I already personal shares in funding belief The Renewables Infrastructure Group, and I’m looking for to purchase extra inexperienced vitality shares to spice up my publicity.

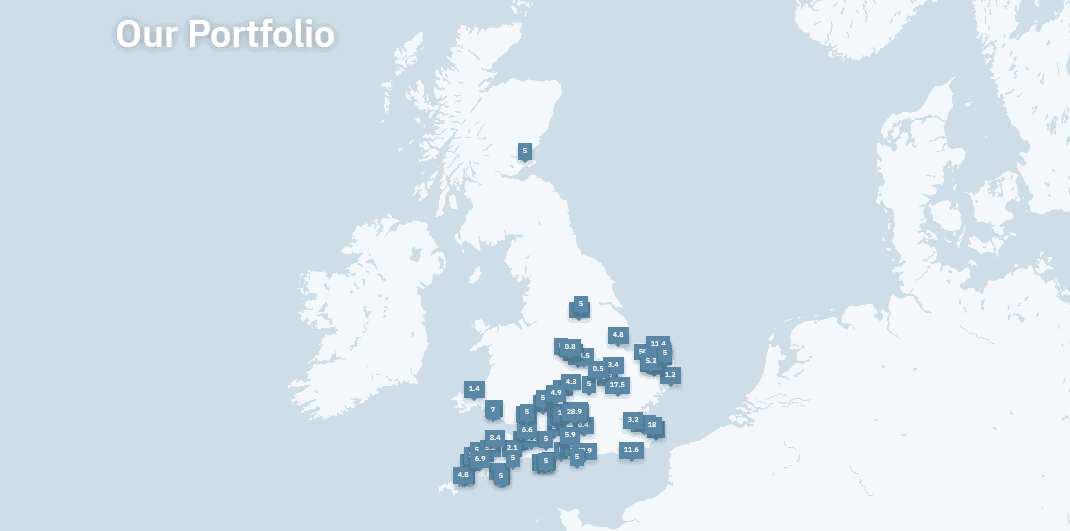

One such enterprise on my radar right now is Bluefield Photo voltaic Revenue Fund (LSE:BSIF), which has a portfolio of greater than 200 photo voltaic farms within the UK.

Demand for inexperienced vitality is hovering as oil and gasoline turns into more and more retro. In line with Carbon Temporary, electrical energy generated from fossil fuels within the UK dropped to its lowest since 1957 final 12 months as renewables capability stepped increased.

After all there’s no assure that Bluefield will be capable to capitalise on this development business. Throughout cloudy circumstances, energy technology can stoop which, in flip, can pull income decrease. Technological failures may play havoc with the underside line.

Nevertheless, this FTSE 250 operator’s intensive asset portfolio helps to cut back this danger. Because the map under exhibits, its portfolio of UK photo voltaic farms is fairly spectacular.

I feel Bluefield is an particularly nice inventory to purchase at present costs. At 114p, the corporate’s share value trades at a whopping low cost to the worth of the agency’s property. Its internet asset worth (NAV) per share is at present estimated at round 136.7p.

The renewable vitality play additionally carries a mighty 7.6% dividend yield right now.

Like Authorized & Basic, I feel it could possibly be an effective way to generate a big (and rising) passive earnings within the years forward.