Picture supply: Getty Photos

After the April we’ve simply had, saying with confidence what Might will carry within the inventory market is a daring transfer. However I don’t suppose there’s ever a nasty time to be high quality development shares.

Whether or not it’s the UK or the US, there are alternatives price contemplating. For traders seeking to construct wealth, these are names that ought to be on the radar.

3i – a FTSE 100 compounder

At first sight, it’s tough to see proper now as a very good time to contemplate shopping for shares in 3i (LSE:III). The inventory is at an all-time excessive and up 722% during the last 10 years.

Other than a few current additions, the inventory has left the remainder of the FTSE 100 within the mud. And traders shouldn’t be too fast to conclude the chance has handed.

What has set the non-public fairness agency above its friends is the actual fact it has centered on investing its personal capital, relatively than cash from exterior traders. And that is nonetheless the case.

One among Warren Buffett’s most essential rules is that investing nicely is about being grasping when others are fearful. And 3i’s construction has given it a singular skill to do that.

Its funding portfolio is closely concentrated in a single asset – a European low cost retailer. And whereas the corporate has carried out exceptionally nicely, a scarcity of diversification may be dangerous.

That is one thing traders ought to keep in mind within the context of their very own portfolios. However I believe 3i is a top quality firm that would proceed to do nicely for shareholders for a very long time.

Amazon – development in all the precise locations

The Amazon (NASDAQ:AMZN) share worth has fallen nearly 15% because the begin of the yr. And the agency remains to be rising strongly and I believe the inventory is unusually good worth proper now.

On each a price-to-earnings (P/E) and a price-to-book (P/B) foundation, Amazon shares are at a few of their lowest ranges within the final 5 years. And the rationale for that’s pretty clear.

The corporate’s on-line platform does enterprise all around the globe. So elevated prices of worldwide commerce are a transparent and real threat for the agency.

That’s why the share worth has been falling. However the firm’s most up-to-date earnings report is an efficient illustration of why I believe it is a good time to contemplate shopping for the inventory.

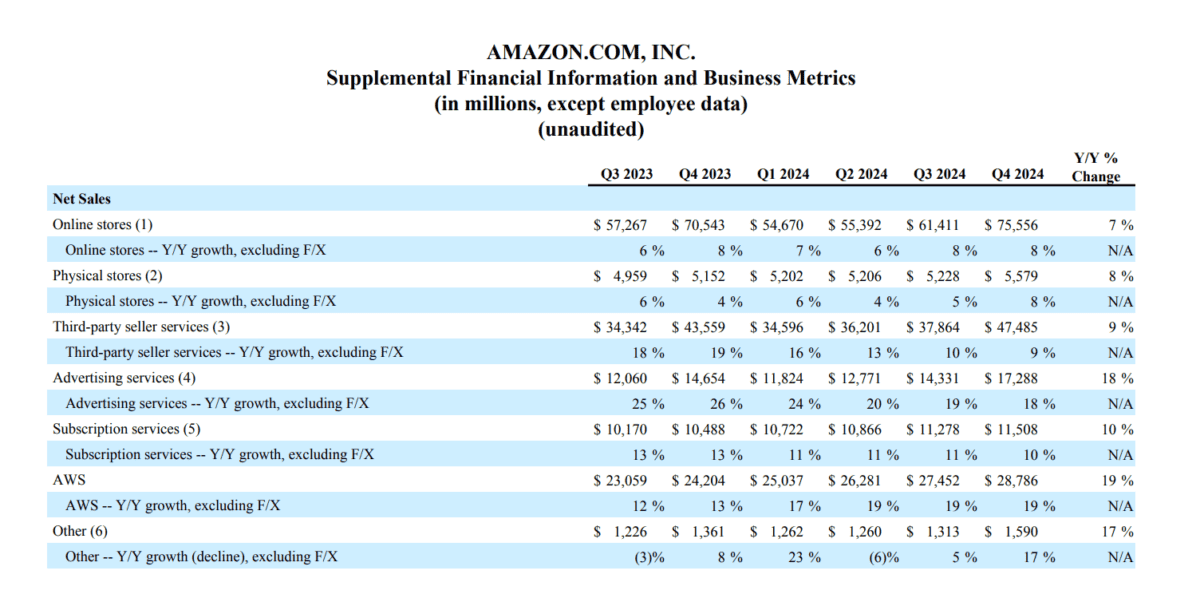

Supply: Amazon This autumn Outcomes 2024

General revenues are up 10%, however the actually fascinating factor for my part is the place this development has come from. It’s been pushed by the cloud computing division and the promoting unit.

Each of those are high-margin companies, that means earnings have been rising quickly as gross sales in these divisions improve. And this seems to be like a strong mixture going ahead.

High quality companies

When it comes to share costs, 3i and Amazon have had contrasting fortunes because the begin of the yr. However each look to me like high quality companies with excellent long-term prospects.

From an funding perspective, that is what issues essentially the most. Whereas there are not any ensures, that is what offers traders the very best likelihood of getting a robust return over the long run.