Picture supply: Getty Pictures

Powerful market circumstances imply that Authorized & Basic (LSE:LGEN) shares have delivered an underwhelming return since April 2015.

At 249.8p per share, the FTSE 100 firm has dropped 5.7% in worth over the previous decade from 265.10p. It signifies that £10,000 value of shares bought a decade in the past is now value £9,430.

This isn’t the type of efficiency long-term holders of Authorized & Basic shares would have been hoping for. Nevertheless, a gradual circulate of blue-chip-beating dividends means the general return isn’t as poor because the inventory worth alone suggests.

Since late April 2015, the monetary providers big has paid dividends totalling 167.17p a share. As a consequence, somebody who invested £10k again then would have made a complete return of £12,860, or 28.6%.

That’s far under the FTSE 100 common of round 84.2%. Nevertheless, might Authorized & Basic shares present index-beating returns going ahead? And may traders take into account shopping for the corporate at this time?

Costs to rise?

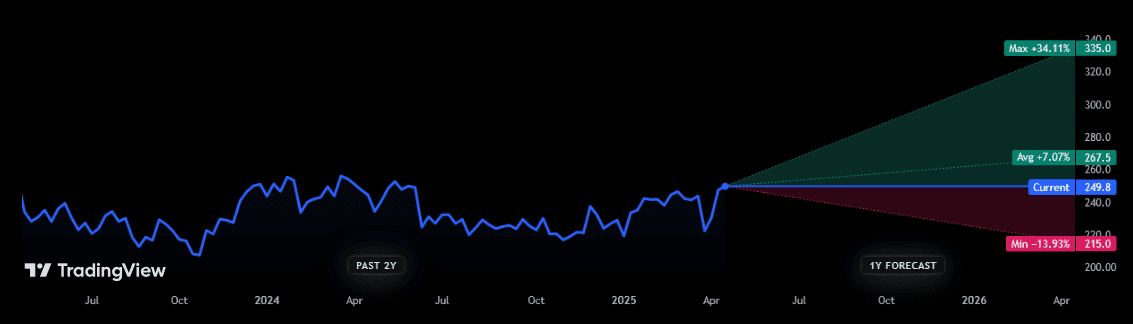

Sadly, Metropolis analysts don’t present worth forecasts for the subsequent 10 years. Nevertheless, estimates can be found for the subsequent 12 months, and so they present room for optimism.

The 15 analysts with scores on Authorized & Basic shares imagine they’ll respect by mid-single-digit percentages over the subsequent yr. Nevertheless, analysts aren’t united of their evaluation, because the chart above exhibits.

But with brokers additionally tipping extra market-beating dividends, I feel there’s an excellent likelihood of a strong return within the short-to-medium time period. Dividend yields sit above 9% for every of the subsequent three years.

Between 2025 and 2027, Authorized & Basic plans to return round 40% of its market capitalisation (£5bn) to shareholders by a mixture of dividends and share buybacks. With a powerful steadiness sheet — its Solvency II capital ratio completed 2024 at 232% — the corporate appears in nice form to hit this goal too.

Ought to traders purchase Authorized & Basic shares?

That stated, I’m extra assured in Authorized & Basic’s dividend prospects than its share worth. By specialising in discretionary monetary merchandise (assume asset administration, life insurance coverage, and retirement merchandise), it’s in peril of stagnating and even falling as the worldwide financial struggles for traction.

The introduction of ‘Trump Tariffs’ and reciprocal motion from the US’ buying and selling companions threatens to choke off development. It additionally means inflationary pressures might rise, placing additional stress on client spending.

However as a long-term investor, I imagine Authorized & Basic is a good share to contemplate (I maintain it in my very own portfolio). I imagine earnings will rise strongly over the subsequent decade and past, pushed by speedy inhabitants ageing throughout its markets and the rising significance of monetary planning. This might turbocharge demand for the providers it specialises in.

Within the meantime, traders can console themselves with these 9%-yielding dividends, even when Authorized & Basic’s share worth underperforms. On steadiness, I feel the corporate might show one of many FTSE 100’s standout buys over the long run.