Picture supply: Getty Photos

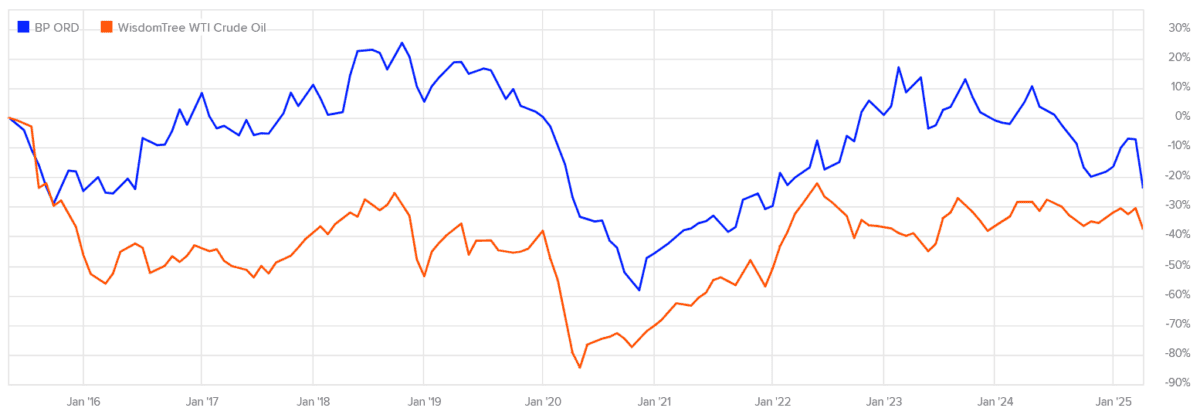

A fall in oil costs over the past decade has prompted a corresponding fall in BP (LSE:BP.) shares over the interval. At 359.4p per share, the FTSE 100 oil main is now 23.6% cheaper than 10 years in the past when it was buying and selling at 470.1p. Because of this somebody who invested £10,000 again then would have seen the worth of their funding dwindle to £7,644.

However BP shares aren’t fairly the dumpster fireplace they look like at first look. Due to a gradual stream of blue-chip-beating dividends — figuring out at 253.5p per share since mid-2015 — a £10k funding within the firm would have delivered a complete return of £13,037, or 30.4%.

The primary rule of investing isn’t to lose cash, says investing guru Warren Buffett. So somebody who invested within the oilie 10 years in the past would have handed that take a look at. In truth, they’d have made a revenue.

But in comparison with the broader FTSE 100, the return on BP shares has been fairly poor over the interval. They’ve offered a median annual return of two.7%, nicely under the Footsie common of 6.4%.

However can they supply a greater return shifting forwards? And will I think about shopping for the corporate right now?

Shiny forecasts

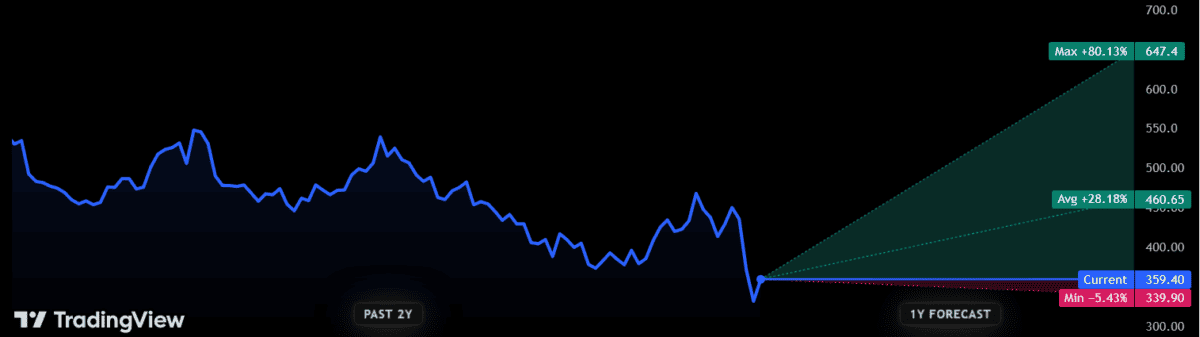

Sadly, forecasts for BP’s share value by to 2035 are unavailable. However estimates can be found for the subsequent 12 months. And broadly talking, they’re fairly optimistic.

There are at present 26 analysts with scores on BP shares proper now. And so they’ve slapped a median value goal round 460.7p on them, up greater than 1 / 4 from present ranges:

The opinion on BP’s value course does fluctuate amongst this grouping nevertheless. One analyst thinks the oil producer will fall to round 339.9p per share over the subsequent 12 months.

However as you may see, present projections are optimistic. One particularly bullish forecaster thinks BP will transfer inside a whisker of 650p, a stage not seen April 2010.

Ought to I purchase BP shares?

BP is aware of its share value has dissatisfied over the previous decade. So it’s not too long ago taken steps to overtake its technique to spice up money flows and get its debt down. This consists of pivoting away from inexperienced power to concentrate on oil manufacturing. It’s additionally in search of to chop working prices throughout the group.

Sadly although, BP’s resolution to prioritise fossil fuels comes at a time when oil costs are sinking once more. Brent crude sank to four-year lows this month on fears of a worldwide commerce conflict, indicators of an financial slowdown, and information of rising output from OPEC+ nations.

Commodity markets are famously unstable nevertheless. And components like a falling US greenback and lowered rig exercise Stateside may assist oil get well floor.

However on the entire, the outlook for crude costs is fairly bleak, which is a worrying omen for BP. Certainly, HSBC has minimize its common value forecasts to $68.50 and $65 per barrel for 2025 and 2026 respectively. That compares with $67.70 not too long ago.

This might not solely spell bother for BP’s share value, however given the corporate’s large money owed, I worry it might additionally trigger a pointy dividend minimize. Internet debt’s estimated to have been $27bn on the finish of Q1, up $4bn from December.

Given its bleak prospects for the subsequent 12 months and past, I’m comfortable to keep away from BP shares proper now.