Picture supply: Getty Pictures

Not like the S&P 500, the FTSE 100 is labouring this yr. But that doesn’t imply there aren’t nonetheless thrilling Footsie shares to purchase, with some even providing publicity to the expansion of synthetic intelligence (AI).

Right here’s one I intend to snap up in February.

An information big

On the high of my purchase checklist proper now could be London Inventory Alternate Group (LSE: LSEG). That is regardless of the share worth being close to an all-time excessive after rising from 4.685p to eight,883p over the previous 5 years.

At first look, this robust share worth momentum may seem counterintuitive. In spite of everything, the temper music across the London Inventory Alternate is sombre these days due a scarcity of latest listings and a few firms deciding to maneuver to New York seeking larger valuations.

Nevertheless, the trade enterprise solely accounts for round 3% of income. The Group itself is a worldwide knowledge and analytics firm that seems to have a few years of worthwhile development forward of it.

A transformative acquisition

In 2021, it acquired Refinitiv for $27bn. This can be a main supplier of real-time monetary market knowledge and infrastructure with over 40,000 prospects (banks, wealth managers, hedge funds, and many others).

These organisations glean essential insights by way of its knowledge, analytics, AI, and workflow options. Additionally it is the only supplier of Reuters information to the worldwide monetary market.

Given the indispensable function that real-time monetary knowledge performs within the workflow of a finance skilled, that is an extremely sticky enterprise. And this makes a good portion of the Group’s income recurring (73% in 2022).

Dangers

Now, all-weather expertise companies that generate dependable income like this are normally extremely valued. London Inventory Alternate Group isn’t any exception.

Presently, the inventory is buying and selling on a ahead price-to-earnings (P/E) ratio of 24.5 primarily based on analyst forecasts for 2024. This might add a little bit of valuation danger if earnings are available mild.

One other factor to concentrate on is that there’s nonetheless a good bit of debt from the huge Refinitiv acquisition. This might turn into a problem if it lingers on the stability sheet longer than anticipated.

That mentioned, Metropolis analysts anticipate the Group to generate free money stream of round £2.3bn from income of £8.7bn in 2024. So the corporate is in impolite well being financially, which is essential when there’s vital debt.

Synthetic intelligence

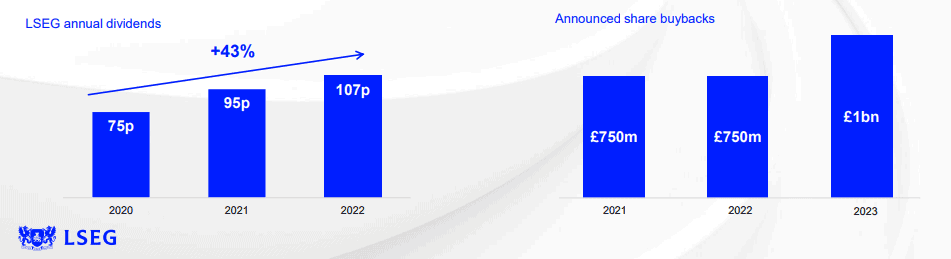

There’s additionally a dividend yielding 1.3%. Whereas which may appear laughably small, the payout has greater than doubled in 5 years. Simply lined by earnings, this can be a dividend I can see rising for a really very long time.

Complementing this can be a additional £1bn share buyback programme in 2024.

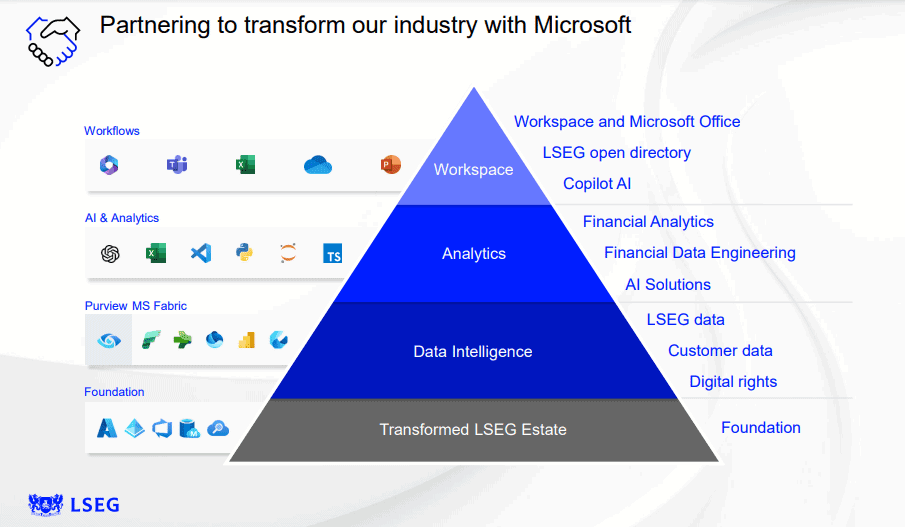

Lastly, I’m excited by the agency’s 10-year three way partnership with Microsoft.

Launched in December 2022, this centres round constructing highly effective generative AI-based options for purchasers throughout the monetary trade.

The corporate has one of many largest and cleanest monetary knowledge units on the planet, which is essential for coaching AI fashions successfully. Pair this with Microsoft’s experience in AI and these merchandise might considerably improve the corporate’s aggressive place.

The very fact Microsoft additionally took a 4% stake within the Group is an incredible vote of confidence in its future.